Lowe’s and Home Depot just released their 2nd Quarter earnings reports, marking the seventh straight quarter with negative comp-store sales and slightly lowered forecasts for 2024. But before you get discouraged, let’s look at the bright side.

As the leading installation management software for Lowe’s and Home Depot installers, Cilio is here to highlight the opportunities that still exist in today’s home improvement market. Despite the challenges, there are promising signs that can help you stay ahead and grow your business.

Key Insights from Lowe’s and Home Depot Q2 Reports

Both Lowe’s and Home Depot cited external pressures, such as economic uncertainty and weather challenges, for their slight reduction in full-year outlooks. While both companies reported declines in overall sales, largely due to reduced big-ticket discretionary purchases, the outlook isn’t bleak.

Reading between the lines, the home improvement market still holds significant opportunities, especially for home installation companies. Here are the positive signs:

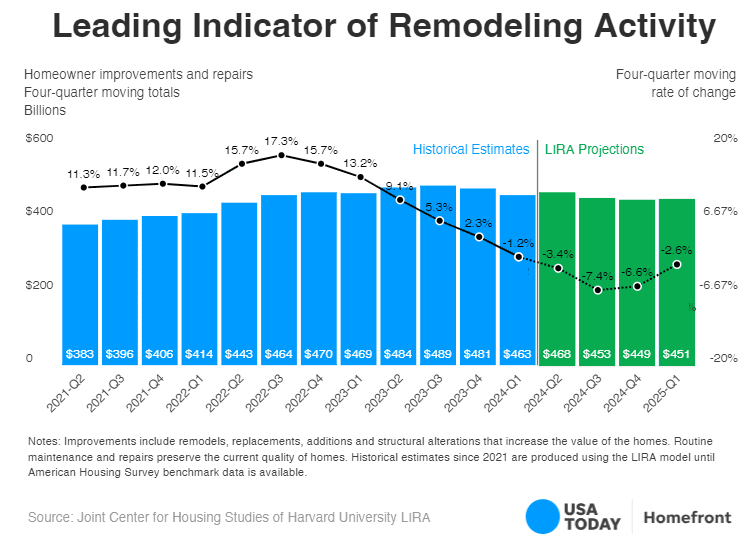

The Size of the Market

The home improvement market is huge, equaling $657B billion dollars nationwide. The current average home improvement investment is $10,341.

Consumer Confidence Is On the Rise

There’s a slight uptick in consumer confidence, with expectations that the Fed will cut interest rates in September. This could rejuvenate spending in the home improvement sector.

Resilient Non-Discretionary Business

The demand for water heaters, windows and doors is trending upward, suggesting ongoing opportunities in this area of home improvement.

Seasonal Opportunities

As we move into fall, a key period for home installation services, homeowners will be looking to get exterior projects complete before winter and important interior projects (flooring, bath, kitchens and countertops) done by Thanksgiving to make for a delightful holiday season.

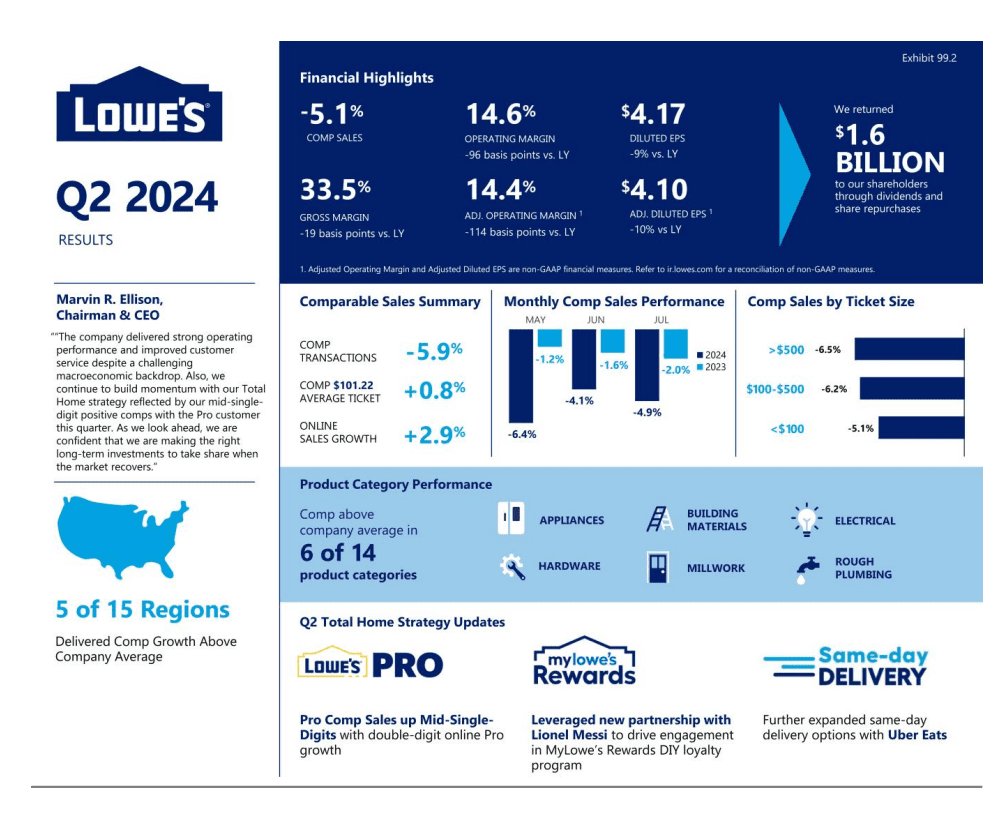

The Lowe’s Earnings Report

Lowe’s continues to lean-in with Installation Services being one of their top 5 priorities (see image below) as part of the Total Home Strategy. Despite a reported decline in sales, Pro comp sales were up in the mid single digit range with double-digit online Pro growth.

Six out of fourteen categories showed above average performance, including millwork and building materials in Pro, driven by consumers investing in home improvements for aging homes.

Mark your calendars for the next Lowe’s earnings report on November 19th.

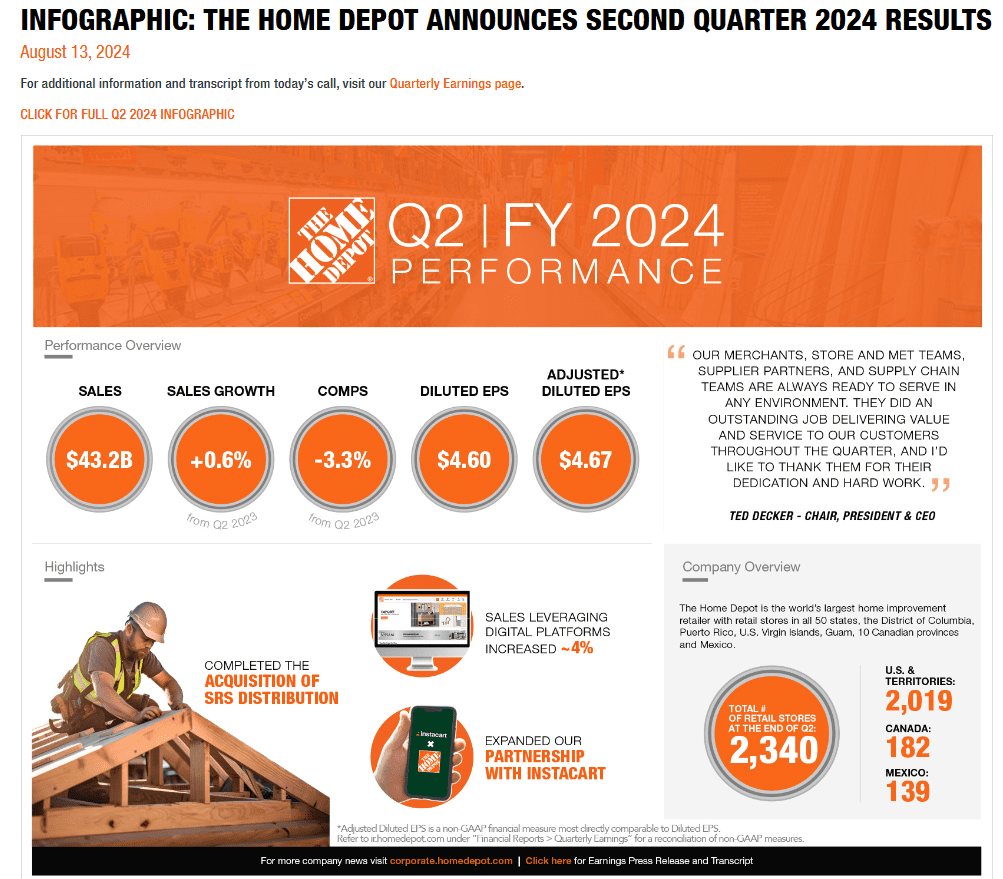

The Home Depot Earnings Report

While the forecast for comp sales was further revised downward, Home Depot is bullish about the opportunity to increase market share in the home improvement industry. Their report claimed a 17% market share, with additional growth expected into the future.

Home Depot pointed out that their Q2 results were impacted by weaker consumer demand due to high interest rates, but they’re optimistic that this could improve if rates drop in September. Despite the recent dip, they believe the core demand for home improvement remains strong.

Mark your calendars for the next Home Depot earnings report on November 12th.

The Home Improvement Market: A Big Opportunity

Despite the headwinds, the home improvement market remains vast and full of potential. 52% of homeowners planned to renovate their homes in 2024, with a median planned investment of $15,000. Kitchens, guest bathrooms, and primary bathrooms were the top planned investments this year.

According to the 2024 U.S. Houzz & Home Study, Baby Boomers and Gen Xers were the top two generations driving renovations, especially with the housing market forcing homeowners to stay put in older homes. In lieu of buying a new home, they’re choosing to renovate their existing homes.

The passage of the Inflation Reduction Act of 2022 also provides incentives for home efficiency and home energy updates. These rebates cover a wide range of improvements for installers to boost their sales. The rebates cover upgrades associated with water heating, HVAC, windows, doors, insulation, appliances, and more. This is a big opportunity for home installation companies to attract more customers looking to capitalize on the projected renovation boom through 2024 and 2025.

How to Position Your Business for Success

Supporting a big box sales channel, like Lowe’s and Home Depot, provides contractors with a more stable line of revenue. These retail stores function as recurring “home shows” that allow you to increase your volume of jobs without the investment in marketing. Now is the time to take full advantage of the opportunities these large retailers offer.

If you’re not currently a big box installer, you can read more about how to become a Lowe’s PROvider or Home Depot installer. While the earnings reports seemed negative on the surface, the larger picture shows a greater opportunity for home installers to benefit from the growing focus on home renovations.

Technology has proven to be a leading way to drive efficiency & productivity while improving the quality of the customer experience you deliver.

Cilio helps your business run more efficiently, keeping your crews productive and customers satisfied. As we approach the busy fall season, improving your scheduling, reducing errors, and enhancing customer communication gives you the edge needed to capitalize on this moment.

With Cilio, big box installers can boost their operations using time-saving automation, real-time project insights, and superior integration with their sales channels.

In essence, you can “do more with less” and avoid the costly mistakes that cut into profits.

Looking ahead to 2025, we can expect a more favorable business environment, with potentially higher demand as lower interest rates spur more economic activity. Using Cilio today ensures that your business not only survives but thrives as market conditions improve.

Contact us today to see Cilio in action and make the move to superior install management!

About Cilio: Cilio Technologies is committed to helping manufacturers, fabricators, and home product installers simplify their business processes, improve communication among their teams, and reduce paperwork. For nearly 20 years, we have supported Lowe’s and Home Depot with contract management system software for installers and fabricators.