The latest earnings reports from major home improvement retailers paint a clear picture: the home improvement market is evolving, and there’s still plenty of opportunity for those who are ready to adapt. The residential home improvement industry is HUGE, and market share can be taken for companies who move aggressively to prepare for the pent-up demand for home improvements.

Cilio is the leading installation management software for home contractors and Big Box providers. We are here to showcase the opportunities still thriving in today’s home improvement market. While challenges remain, there are plenty of bright spots to help you stay competitive and grow your business.

With interest rate relief and a projected improvement in macroeconomic conditions, now is the time to modernize your home installation business to prepare for what appears to be more growth opportunities ahead.

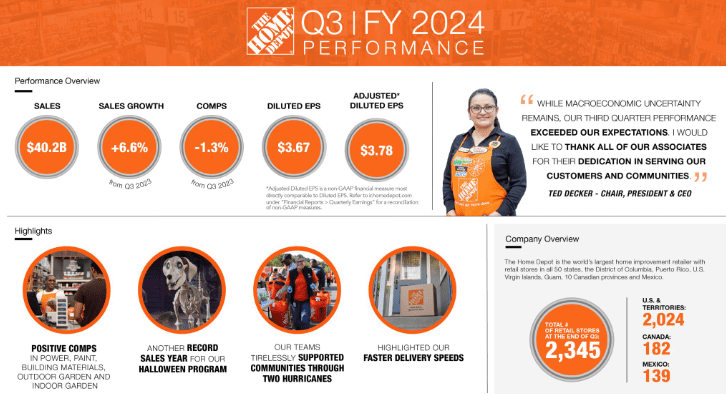

Home Depot: Signs of Economic Stabilization

Home Depot reported solid overall growth in Q3, with sales up 6.6%. Warmer weather and an active hurricane season played a big role here. While store comps were still down by -1.2%, this is better than the -3.6% decline they saw last quarter, showing that the market might be stabilizing or improving as we shift into 2025.

Pro Sales Are Stronger Than DIY

Home Depot saw Pro sales outpacing DIY. If you’re a contractor working with Home Depot, now’s the time to lean into this partnership. Their loyalty programs are advertised on the Home Depot website, or you could join their contractor network. Read our blog to learn How to Become a Home Depot Contractor and take advantage of the many benefits that come from working with Home Depot.

Big-Ticket Purchases Lagging

Big ticket transactions over $1,000 (think kitchen and bath remodels) were down -6.8% compared to the 3rd Quarter, but non-discretionary jobs – like water heaters and HVAC systems – are holding strong. Focus on these areas to keep the momentum going.

Lowe’s: All Eyes on Pro Customers and Installation Services

Lowe’s comparable sales dipped by -1.1%, driven by softer DIY demand for big-ticket projects. However, Pro sales grew by high single digits, and appliances performed well. Their CEO highlighted key market strengths, like aging homes and $31 trillion in home equity, as drivers for future home improvements.

Lowe’s CEO and Chairman, Marvin Ellison, highlighted several key factors that demonstrate the strength of the home improvement market:

- Approximately 50% of homes have mortgage rates at or below 4%, signaling stability and continued investment in housing.

- Home values have appreciated significantly, adding to homeowner confidence.

- Disposable income is outpacing inflation, giving consumers more spending power.

- The average age of housing stock has surpassed 41 years, creating demand for upgrades.

- There’s a staggering $31 trillion in home equity available for homeowners to leverage.

These factors position Lowe’s to capitalize on the growing demand for “Do-It-For-Me” installation services, making the company well-equipped to expand its market share in this segment.

Installation Services Are a Priority

Lowe’s continues to push its Total Home Strategy, focusing on home installation services. This is great news if you’re part of their network or considering expanding into this market. Read our blog to learn How to Become a Lowe’s Installer.

The Pro Customer Focus

Lowe’s introduced “Shop the Job,” a tool that helps Pro customers shop efficiently. This shows their commitment to supporting contractors like you.

Ace Hardware: Expanding into Services

Ace Hardware saw a +2.8% bump in sales for Q3, though their Home Services division, including handyman work, dropped by -3.4%. Net income dropped -24%, but Ace attributed this decrease to increased planned expenses as the company invests strategically in its supply chain infrastructure and digital marketing efforts to drive future growth.

On the bright side, Ace has been expanding into HVAC with strategic acquisitions, signifying a push to capitalize on non-discretionary home improvement installations.

Keep An Eye On Ace

Although the drop in Home Services seems significant, Ace Hardware is signaling a push for growth by making large investments with an eye on the upcoming opportunities in 2025.

Look at Diversification

If you’re focused on one type of service, consider adding complementary offerings to meet growing demand in non-discretionary categories.

What’s Ahead? Get Ready for Growth

Big remodels might be taking a back seat for the moment, but with a new economic agenda on the horizon it’s expected that homeowners will see an opportunity to upgrade their homes and move on the opportunity to sell as home values rise in response to a reenergized home market.

Non-discretionary work – like HVAC, water heaters, and roofing – is booming. Lennox saw a +15% increase in its Home Comfort business, and Carrier reported double-digit growth in HVAC orders. These are areas homeowners can’t ignore, no matter the economy.

According to the Harvard Joint Center for Housing Studies, residential remodeling is expected to turn toward growth. Aging homes and strong home equity mean homeowners will keep investing in upgrades and maintenance.

Home installation companies that prepare now will be better suited to adapt to the increase in demand that awaits the industry in the new year.

How You Can Capitalize

To thrive in the evolving home improvement market, staying ahead means adopting smarter strategies and tools that simplify your operations and keep you competitive. Incorporating modern software platforms like Cilio allows you to work more efficiently, strengthen relationships with major retailers, and adapt to high-demand areas. Here’s how you can take advantage of today’s opportunities and position your business for long-term success.

Automate Your Operations

Software platforms like Cilio can help you handle leads, schedule jobs, and communicate with clients more efficiently. Many home installation companies reduced headcount in 2024 as demand for services waned. Automation is the secret tool to do more with less.

Stay Close to the Big Players

With Home Depot and Lowe’s focusing on Pro customers and installation services, align your business to take full advantage of these lead generation opportunities. Cilio is the leading platform for Big Box installers, allowing you to automatically fulfill jobs from incoming Big Box sales channels and keep their systems up to date as jobs are completed. Think of Cilio as a one-stop-shop to capitalize on opportunities from Big Box retailers.

Expand Smartly

Diversify into high-demand areas or other essential services to stay competitive. Since the current economic climate favors non-discretionary spending, service categories like HVAC, plumbing, fencing, roofing, and others, will continue to see growth while discretionary remodeling services lag.

Bottom Line

The market is changing, but it’s far from shrinking. All indicators point to more growth in the home installation market as consumers start to take advantage of lower interest rates, increasing equity, and a new economic agenda meant to fuel growth.

Want to Learn How You Can Get Ahead?

Schedule a demo with Cilio and learn how you can work smarter, not harder to modernize your home installation operations and harness growth as it happens.